While Romanian M&A deal volumes increased in H1 2024 compared to H2 2023 by 13.8%, the decrease in deal volumes during the first half of 2024 compared to the same period last year reflects the global trend in deal volumes. This evolution is accompanied by a rise in worldwide deal values by around 20% compared to 2023 levels, marking the strongest opening six-month period for deal making since 2022. Furthermore, established markets are demonstrating clear signs of rebound in 2024, as highlighted by the substantial rise in mega-deals, which bodes well for developing and emerging economies that usually follow the trajectory of developed markets.

Strategic investors retained their dominant hold on Romanian M&A during the first half of 2024, accounting for 93% of deal volume, albeit they announced the same number of deals in H1 2023 (115). Notably, this represents the highest market share of strategic investors since the first half of 2019. Global private equity exits fell to their lowest level in ten years during 2023, resulting in a lack of returns to investors, hindering the ability to raise capital for new funds which has in turn impacted private equity backed acquisitions.

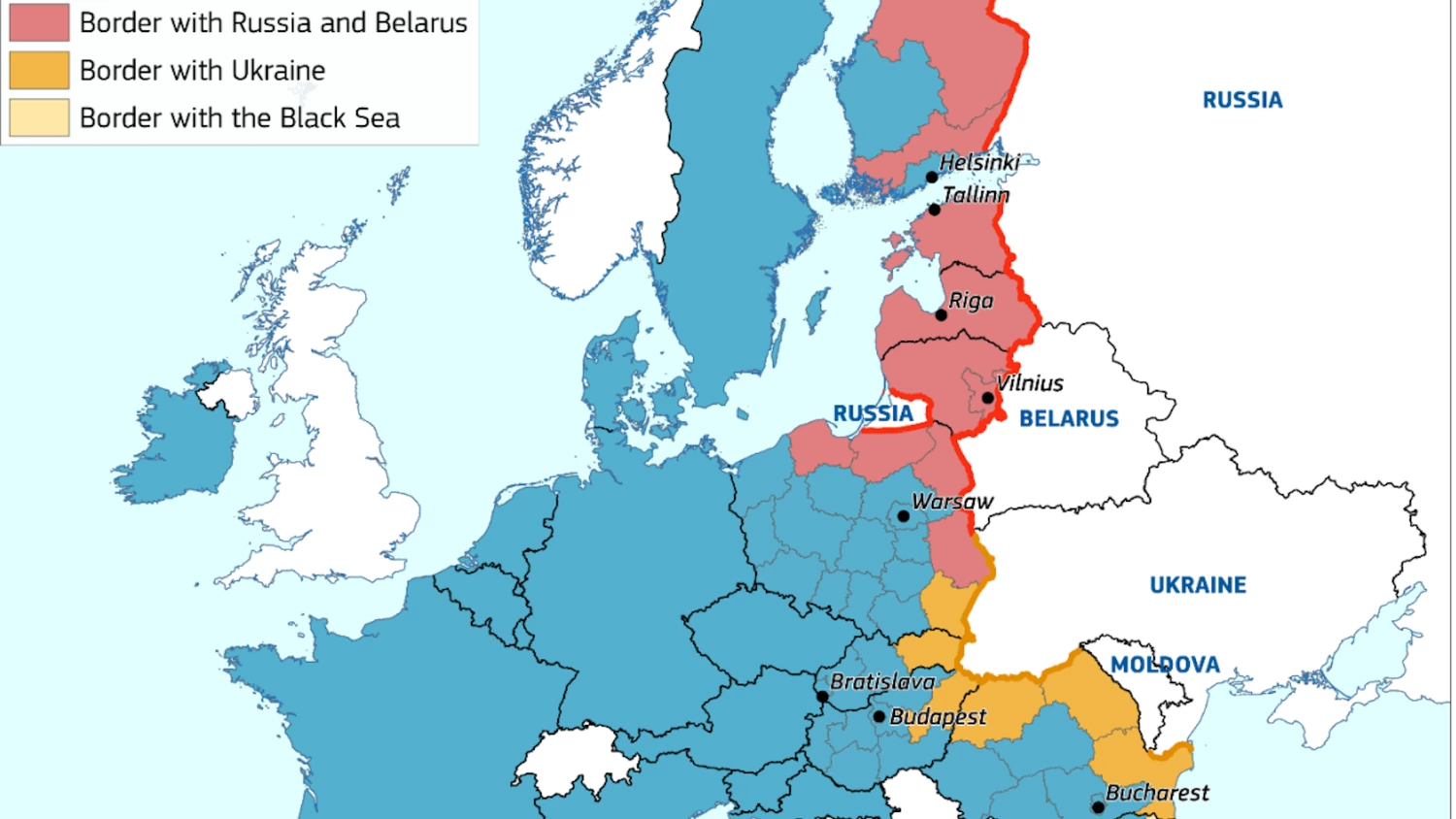

From a cross-border perspective, domestic transactions accounted for 43% of the total number of transactions, with 53 deals recorded in H1 2024. Meanwhile, foreign investor appetite rebounded by 17% compared to H1 2023 with 62 deals, accounting for half of total deal volume, which is aligned with historical patterns.

“The Romanian M&A market has consistently performed well in recent years, as reflected in the rising deal volume numbers, especially over the long term. In the first half of 2024, we have seen particularly positive dynamics in the power and utilities sector, where deal volume almost doubled compared to H1 2023. We are also encouraged by the rebound of global and European M&A activity, driven by a significant increase in announced mega-deals worldwide, as well as the ECB's long-anticipated interest rate adjustment, which will further benefit the dealmaking environment,” said Iulia Bratu, Head of Lead Advisory at EY Romania.

The most active sectors by deal volume were Real Estate, Hospitality & Construction (23 transactions), Power & Utilities (21), and Consumer Products & Retail (20), followed by Health and Technology, each recording 11 transactions. In the first half of the 2024, only 2 transactions with disclosed value surpassing $100 million were recorded, down from 5 in 2023.

The top 3 largest transactions in H1 2024

- The sale of Hungary-based OTP Bank's operations in Romania to Banca Transilvania, the country's largest bank, for a consideration of $375 million.

- ·The acquisition of five light-industrial parks by CTP, Europe's largest publicly listed developer of industrial and logistics properties, from Globalworth Real Estate Investments' wholly-owned logistics portfolio, for approximately $184 million.

- The sale of Mihai Viteazu 80 MW wind farm by Spain-based renewable energy company Iberdrola, to Premier Energy for an estimated $94 million, marking Iberdrola's withdrawal from the local market.

Other notable transactions announced during the first half of the year included:

- The acquisition of a 214 MW solar power project by Enspire Enerji, the investment branch of Turkey-based Entek Elektrik, from Israeli developer Econergy Renewable Energy for $35 million. The target consisted of two companies - Eco Sun Niculesti, which held development rights and permits, and Euromec-Ciocanari, which owned the land rights of the project.

- Investment fund Early Game Ventures' first exit of the year by selling CODA Intelligence, specialized in cybersecurity solutions and one of EGV I's first investments, to PDQ Corporation, an international software asset management company, for $24 million.

Lastly, in terms of country of origin, the most active investors came from the United States – historically a leading investor (10 deals), Austria (8 deals), Germany (7), France and Poland (4 deals each), followed by Italy and the Netherlands, both registering 3 deals.