The acquisition will nearly double the size of Bosch's Home Comfort division, bringing its workforce to over 25,000 employees and its annual sales to over €8 billion.

This strategic move establishes Bosch as a major provider of HVAC solutions for residential and light commercial buildings worldwide. The company is particularly strengthening its presence in the Americas and Asia, which are considered crucial markets for future growth.

According to Bosch's forecasts, the global HVAC market is expected to grow by up to 5% annually until 2030.

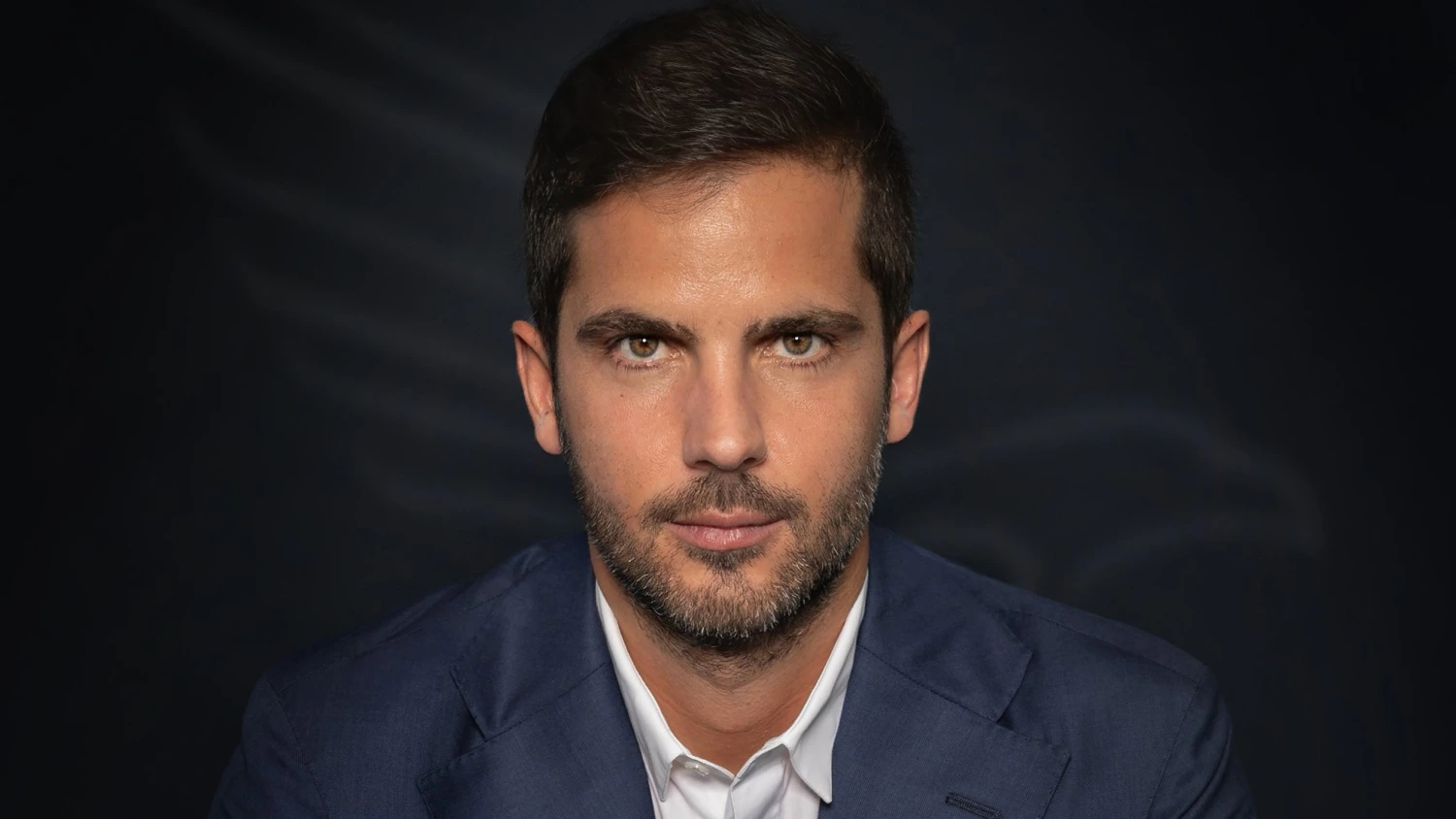

Frank Meyer, the head of Bosch's Building and Energy Technology sector, which includes the Home Comfort division, stated: “We want to help define this market — and use energy-efficient solutions to ensure that people can make their daily lives comfortable and healthy even on increasingly hot days, whether at home, at work or when shopping."

The Home Comfort division's production network will expand from 17 to 33 factories, while the number of development sites will increase from 14 to 26.

The integration of the new units into the Home Comfort division is expected to be completed by the end of 2027. Bosch has also secured long-term licenses to use the brand names York in the US and Hitachi in Asia, thereby strengthening its portfolio of brands.