Affinity Life Care currently operates three premium centers in Bucharest with a capacity of over 400 licensed beds.

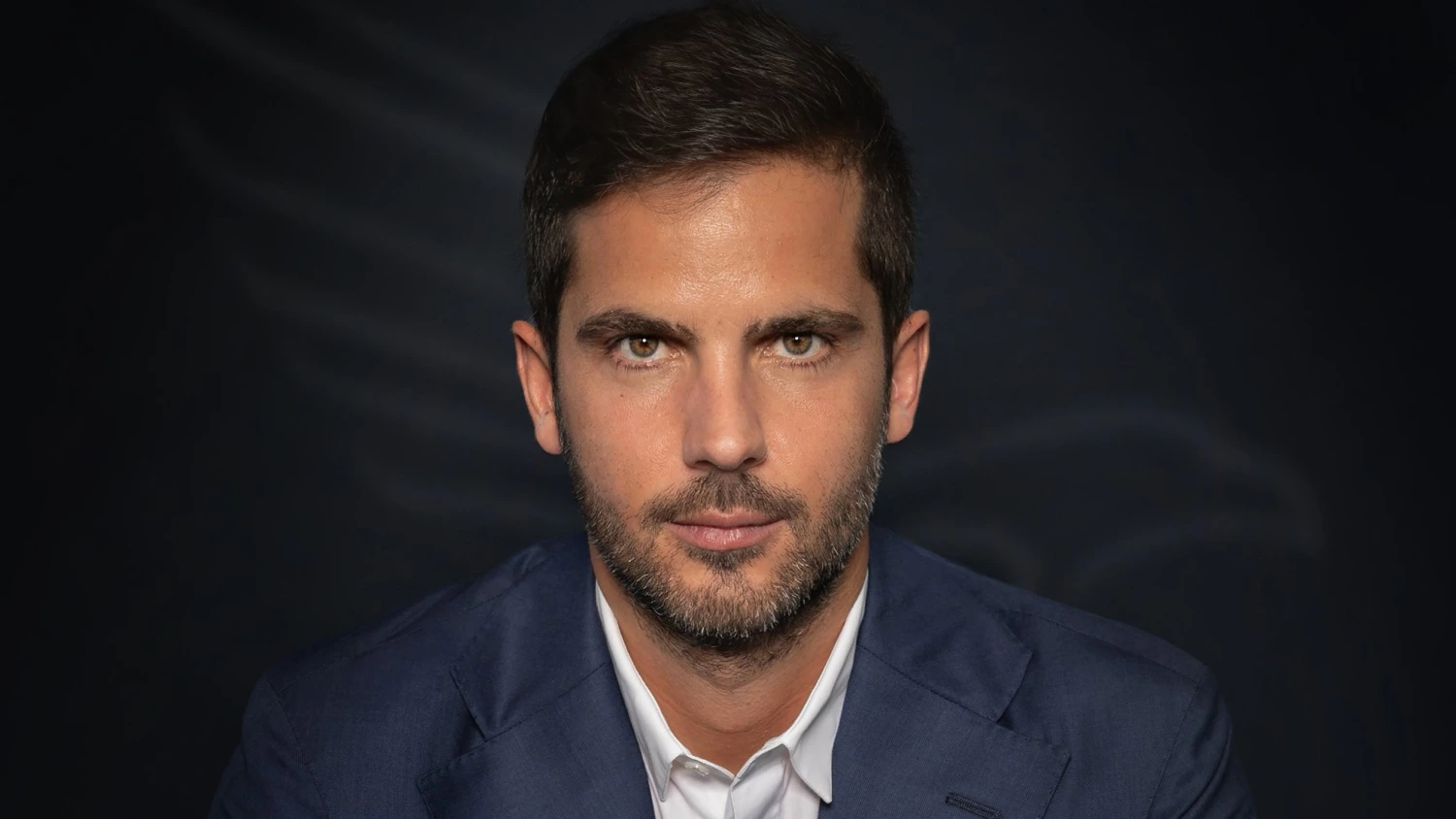

Virgil Chițu, Romania Lead with BlackPeak Capital, said: "Affinity represents the first investment by a private equity fund in Romania's senior care sector, and we see it as a big responsibility towards current and future residents, employees, and the industry."

"This transaction brings growth equity from a regional investment fund to elderly care services, a field which is not institutionalized in the local market, but which has great potential for growth in Romania and in the region," said Radu Dumitrescu, Advisory Partner-in-Charge, Deloitte Romania, which worked with BlackPeak Capital on the deal.

BlackPeak Capital was established in 2014 and targets growth equity investments in fast-growing companies in Romania, Bulgaria, Slovenia, Croatia, and Serbia.