Bucharest's short-term rental market had a booming post-pandemic evolution. In 2023 alone, the industry generated revenues of €41.3 million, nearly double compared to 2019 and 46% over the performance recorded in 2022. With an average of 3,942 listings, this translated into an average yearly revenue of €10,500 and a monthly income of €875 per property. Supply-wise, there were fewer listings in 2023 than in the pre-pandemic 2019, the growth in income coming mainly from an increase of over 60% in the average daily rate (ADR), to €62.

2023 was the first post-pandemic year in which demand reflected growth in the tourism industry, without any extraordinary influencing factors. “If the growth in demand for short-term accommodation in 2022 was in part due to the wave of Ukrainian refugees, 2023 saw a return to typical market conditions, with most guests being leisure and business travelers, as the remaining refugees sought more permanent housing options,” says Ilinca Timofte, Head of Research at Crosspoint Real Estate.

The market also experienced a notable shift in geographical distribution: whereas in previous years, the supply of short-term apartments was primarily concentrated in the city center, there is now a balanced availability of units for short-term accommodation throughout the city.

With an average of 4,550 listings and revenues of approximately €24 million recorded in the first half of this year, Bucharest's short-term rental industry is expected to outperform the previous year's level by more than 25%. The ADR has so far recorded a modest rise, to €63.7 per night, while the occupancy rate has remained similar to that recorded in 2023, at 55%.

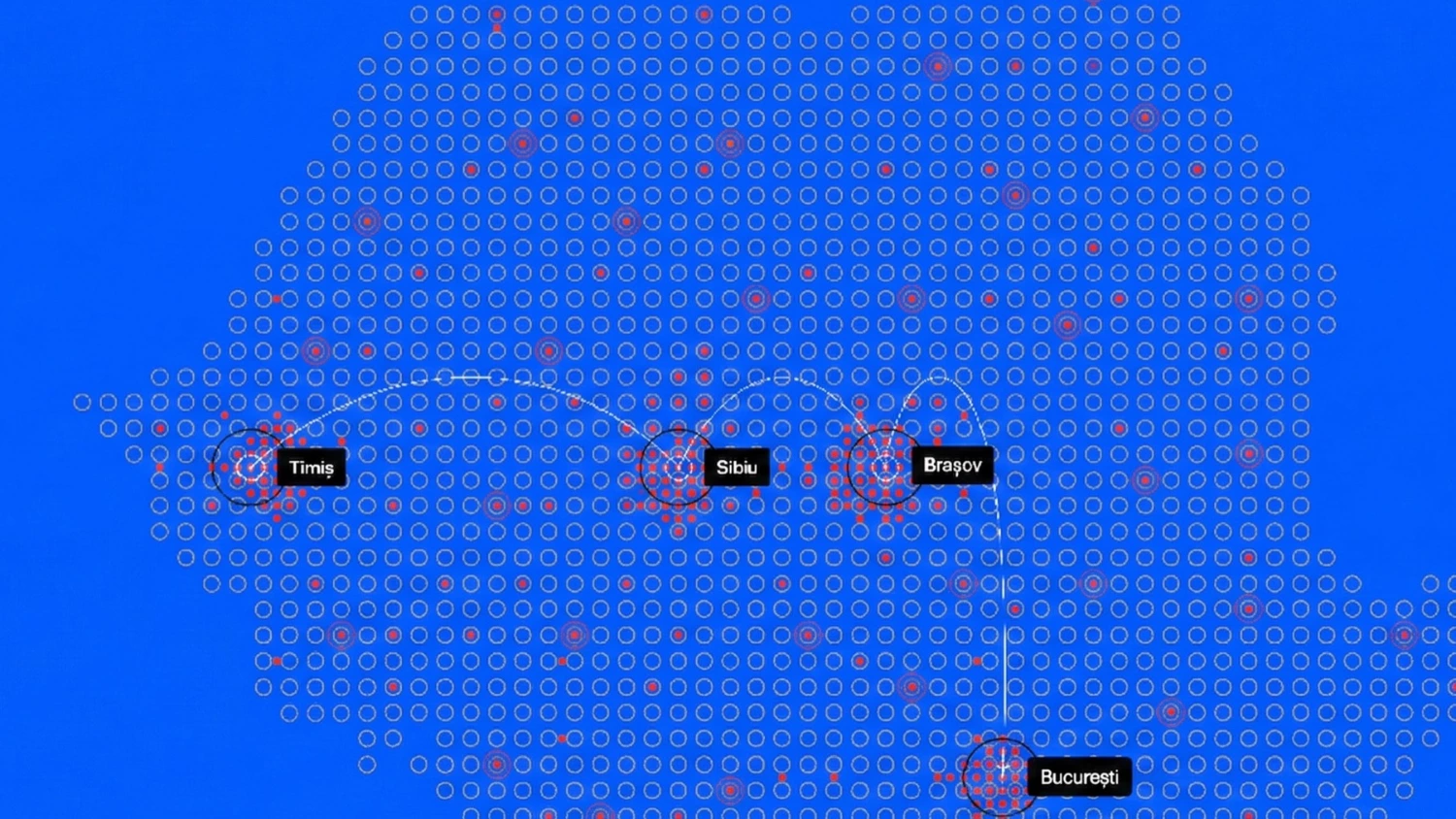

“The industry isn't limited to being profitable only in Bucharest: Brașov, Constanța, and Cluj-Napoca are three regional markets where short-term apartment rentals yield significant returns. In fact, Brașov even slightly surpasses the capital in performance, with an average yearly revenue of €10,923 per property. This demonstrates that other Romanian cities are also thriving in the short-term rental market, offering considerable opportunities for property owners and investors,” adds Timofte.

With a total annual revenue of €9.3 million in 2023, the performance of the short-term property rental market in Cluj-Napoca is partially influenced by the city's hosting two of Romania's largest festivals, Electric Castle and Untold. July and August see the highest number of listings and the highest ADRs. At the other end of the spectrum, regional cities like Iași and Timișoara are still emerging in the short-term rental market and have fewer listings available. Consequently, these cities tend to record lower revenues compared to more established markets.