Only one scheme (5,000 sqm GLA) was delivered during Q1, namely Cometex Hunedoara, this being the lowest recorded quarterly new supply since Q1 2017.

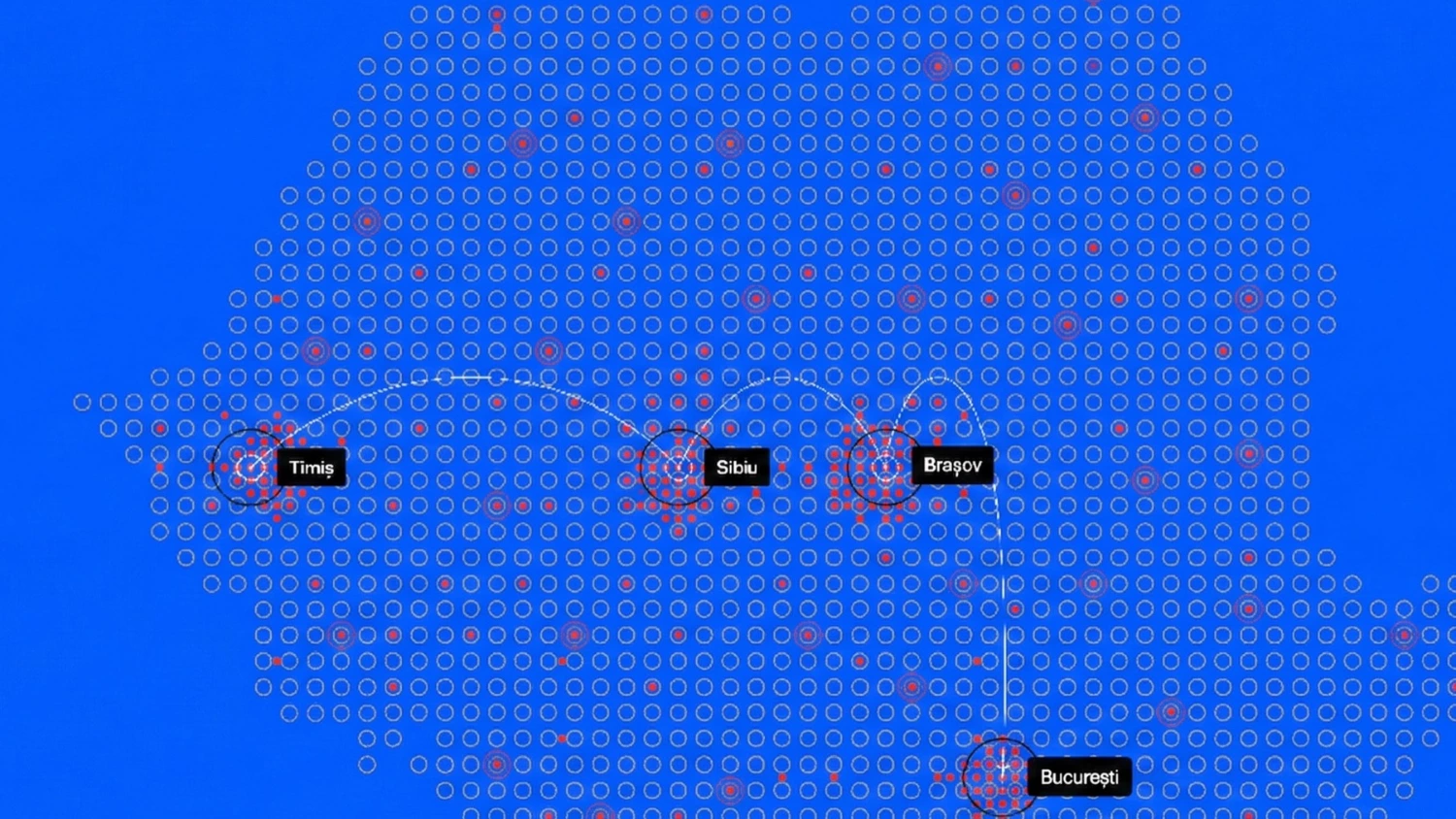

However, April came with the completion of an important project - Arges Mall in Pitesti (51,000 sq. m) developed by Prime Kapital in partnership with MAS Real Estate, while the development activity will remain consistent in the coming months, taking into account the investment plans announced by the major players. Developers will add new schemes or major extensions mainly outside Bucharest, in cities such as Sibiu, Pitesti or Ramnicu Valcea, with Prime Kapital – MAS Real Estate, Oasis Consulting or Cometex having the strongest pipeline on the short term.

A limited new supply was also registered throughout the Central and Eastern Europe in the first quarter, where projects with an area of almost 150,000 sqm were completed, with Poland and Bulgaria accounting for 73% of this total. Retail park projects were once again the preferred asset by developers across the region, Romania included, as over 95% of the Q1 delieveries pertained to this type of development.

Around 1 million sqm of new retail projects were under different construction stages at regional level, out of which ~400,000 sq. m were in Poland, followed by Romania with over 250,000 sqm, Bulgaria with 164,000 sqm and Czechia with 105,000 sqm.

Dana Radoveneanu, Head of Retail Agency Cushman & Wakefield: " Romania is expected to be the second largest beneficiary of new retail projects in the CEE region on the medium and short term, after Poland. The local market has the potential to absorb these investments due to the low average density of retail spaces compared to other CEE countries, as well through the expected wage growth and the decreasing inflation. In addition to investing in new projects, developers will also focus on re-fitting and upgrading of the existing retail schemes (mainly shopping centers) in order to meet the current tenants' requirements and to maintain their competitiveness. It should be noted that close to 70% of the shopping center stock was built more than 10 years ago.”

The prime shopping center rent in Bucharest stood at a level of €80 - €85 / sqm/ month for a 100 - 150 sqm unit located in a dominant shopping center, while the corresponding figures in secondary cities, such as Cluj - Napoca, Timisoara, Iasi and Constanta were ranging between €50 - €65 / sqm/ month, the same situation being observed in tertiary locations, where levels between €30 - €35/ sqm/ month were recorded.