The credit portfolio expanded by 17.2%, reaching RON 45.9 billion (€9.18 billion), while customer deposits grew by 11% to RON 68.8 billion (€13.76 billion).

The bank's operational result saw a 6.7% improvement despite a 32.1% increase in provision costs to RON 46.7 million (€9.34 million), while operational expenses rose by 46.1%, and tax payments increased by 10.6%.

Mihaela Bîtu, CEO of ING Bank Romania, said: "The first part of 2025 was associated with a high level of uncertainty, but our clients have shown resilience and consistency, which is reflected in the growth of our bank's assets and our performance metrics. We remain a committed player in the Romanian economy and a long-term partner for our clients, navigating economic cycles together."

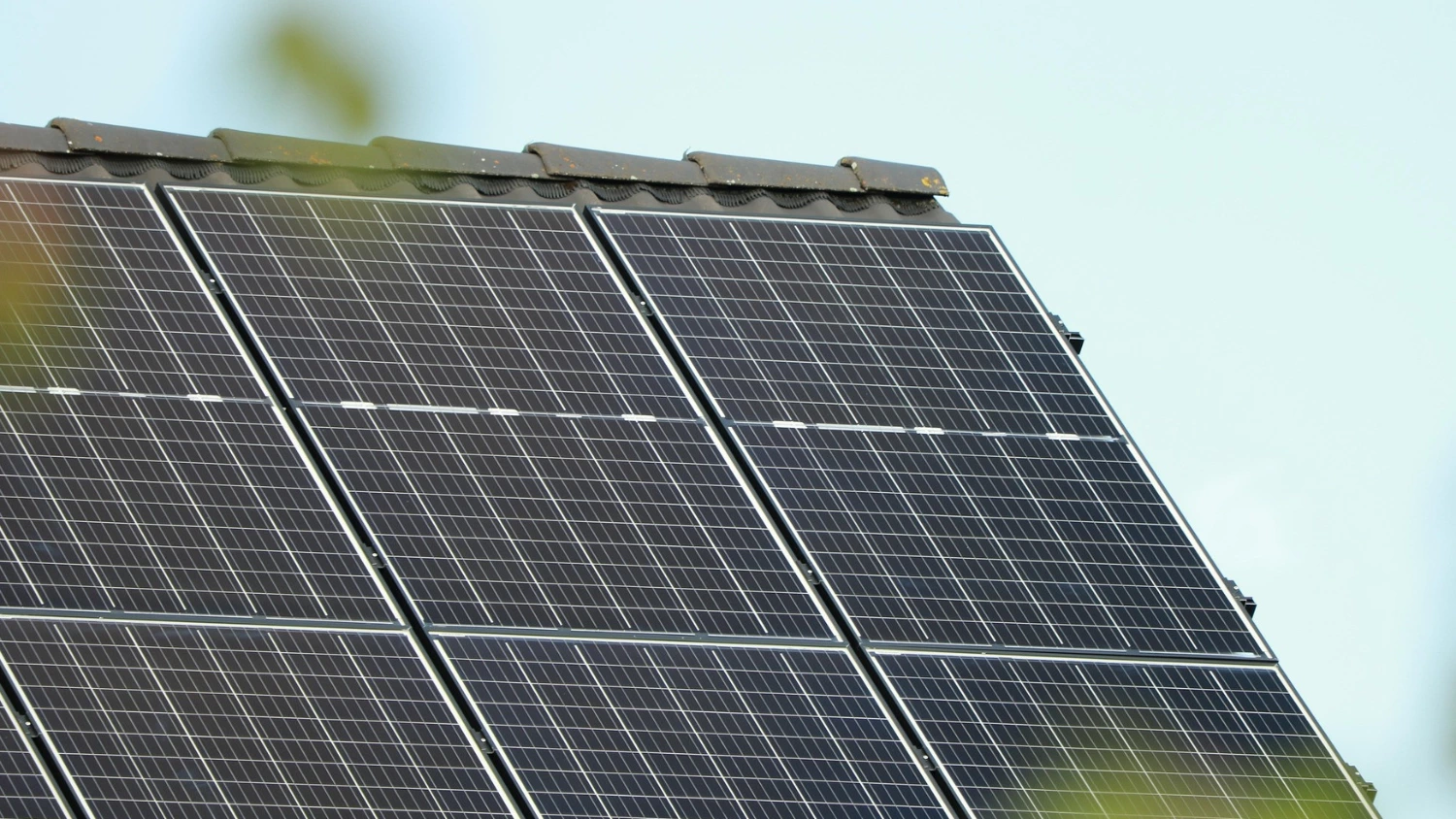

The bank's commitment to a green economy is evident in its financing strategy, with sustainable loans accounting for 39.5% of all new mortgage lending.

In the corporate sector, the bank mobilised approximately €110 million for sustainable financing in H1 2025.

ING Bank Romania also participated in a RON 3.1 billion (€620 million) syndicated financing deal for Electrica, with funds earmarked for investments and refinancing to support renewable energy.