Total construction output in Bulgaria is forecasted to grow by an average of 3.3% in 2024-2026, which is slightly above real GDP growth projections for the same period. The subsector breakdown shows that residential construction is expected to lose momentum, but this is likely to be compensated by a more dynamic performance of non-residential construction and civil engineering.

In Croatia, both building and civil engineering output growth will be strongly influenced by new government laws and regulations.

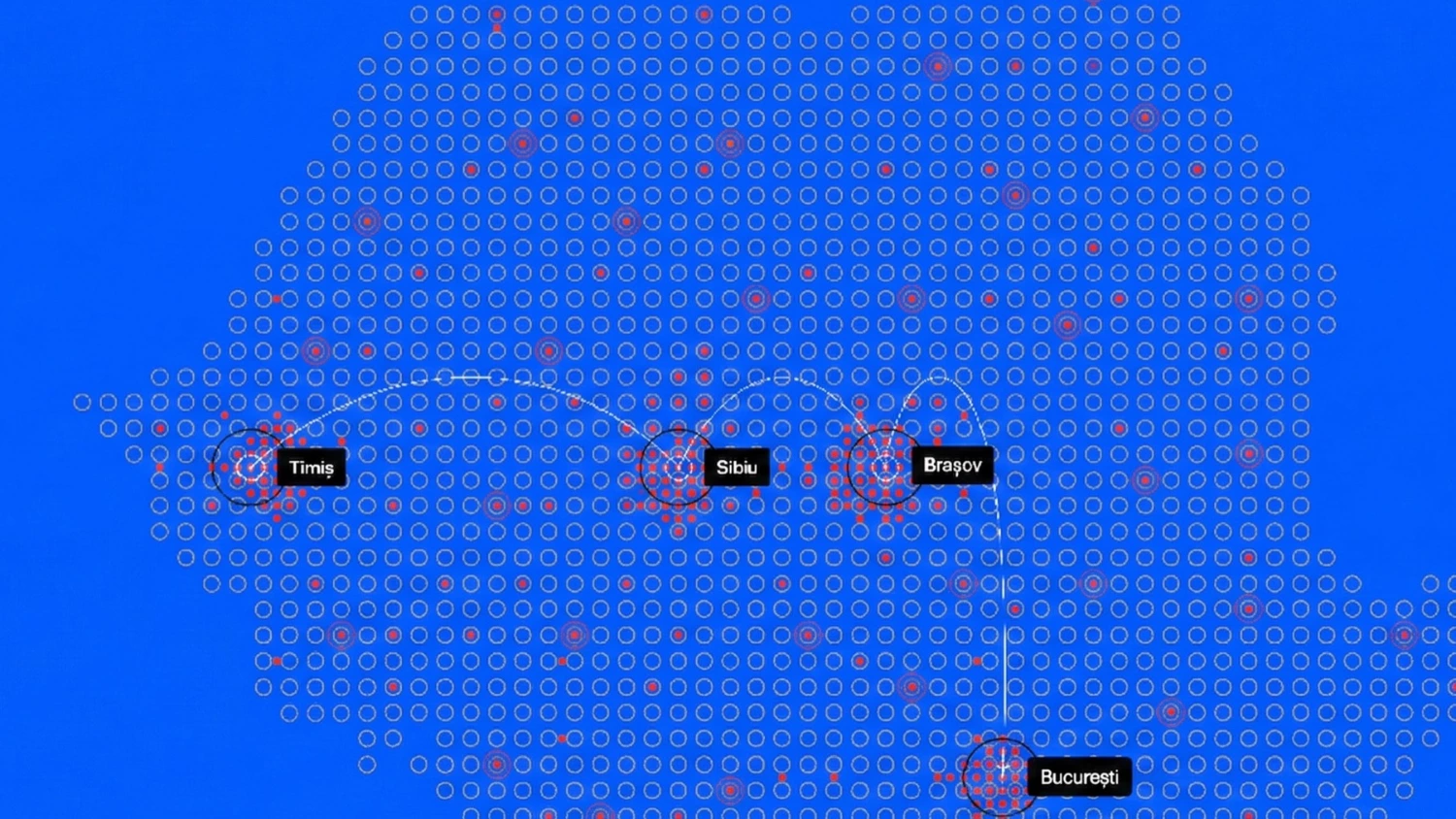

Despite the rise in investment, Romania will likely continue to see a stifled growth in construction in real terms due to costs remaining high. Stubborn inflation and the slightly disappointing macroeconomic performance combined with increased wages and still high interest rates create a less appealing environment for investors in building construction. On the bright side, high income and imports are indicative of strong demand for consumption and could translate to demand for construction.

Serbia's construction is likely to have closed another strong year led by civil engineering, but non-residential construction also entered a new growth cycle with a positive outlook boosted by public investments and the hosting of the EXPO 2027 in Belgrade. The construction of commercial, office and hotel buildings are all set to grow in the coming period, followed by education and health. Residential construction is already on historically high levels with a relatively stable performance. In civil engineering, road and railway construction continues unabated, breaking new record volumes on the way, but other segments also have an impressive project pipeline.

Slovenia's construction sector is expected to maintain post-pandemic levels with annual output consistently exceeding €5 billion up to 2026 against the €3 billion pre-pandemic. Civil engineering in the forecast period will be supported by major infrastructure projects. Residential construction is set to drop slightly first in 2024 before rebounding by 2026 driven by lower mortgage rates. Non-residential construction is forecast to grow steadily but remain dependent on the availability of public financing.

Due to the ongoing war, Ukraine's construction market is facing economic difficulties but the destroyed homes of more than 1.5 million families create a huge demand. Non-residential construction also focuses on the restoration of destroyed buildings and the construction of new ones in safer central and western regions. Civil engineering is also boosted by the renovation of bridges, roads, railways, pipelines, communication and power lines.

Meanwhile, the Russian construction industry fared better than previously expected, driven by the high pace of project implementation and the massive budget support in civil engineering and non-residential construction. It could even offset the negative impacts of the decline in housing construction caused by the end of the mass preferential mortgage program.

In Turkey, the interest rate and the Central Bank's policies had two major effects on the construction sector: big negative real rates of change in construction costs and housing prices. Housing sales are growing as real prices drop and rely on equity financing since mortgage loans have become unaffordable at high interest rates. Building permits in most segments decreased in Q3 2024, while completions had a positive trend.