Notably, the Upstream segment benefited from sustained high production levels at an average of 93 mboepd and rising natural gas prices. In the Downstream sector, improved capacity utilization offset the decline in refinery margins. Consumer Services also contributed positively, driven by both fuel and non-fuel product sales. Additionally, Circular Economy Services delivered a positive EBITDA contribution, supported by one-off items.

However, the Gas Midstream segment experienced a decline in performance despite high transmission volumes, due to the less favorable macroeconomic environment.

MOL Group's Chairman-CEO, Zsolt Hernádi, commented on the results: “In a period marked by geopolitical tensions and economic transformation, we managed to deliver stable performance. The good news is that our positive results were primarily driven by improved internal performance across nearly all our business segments."

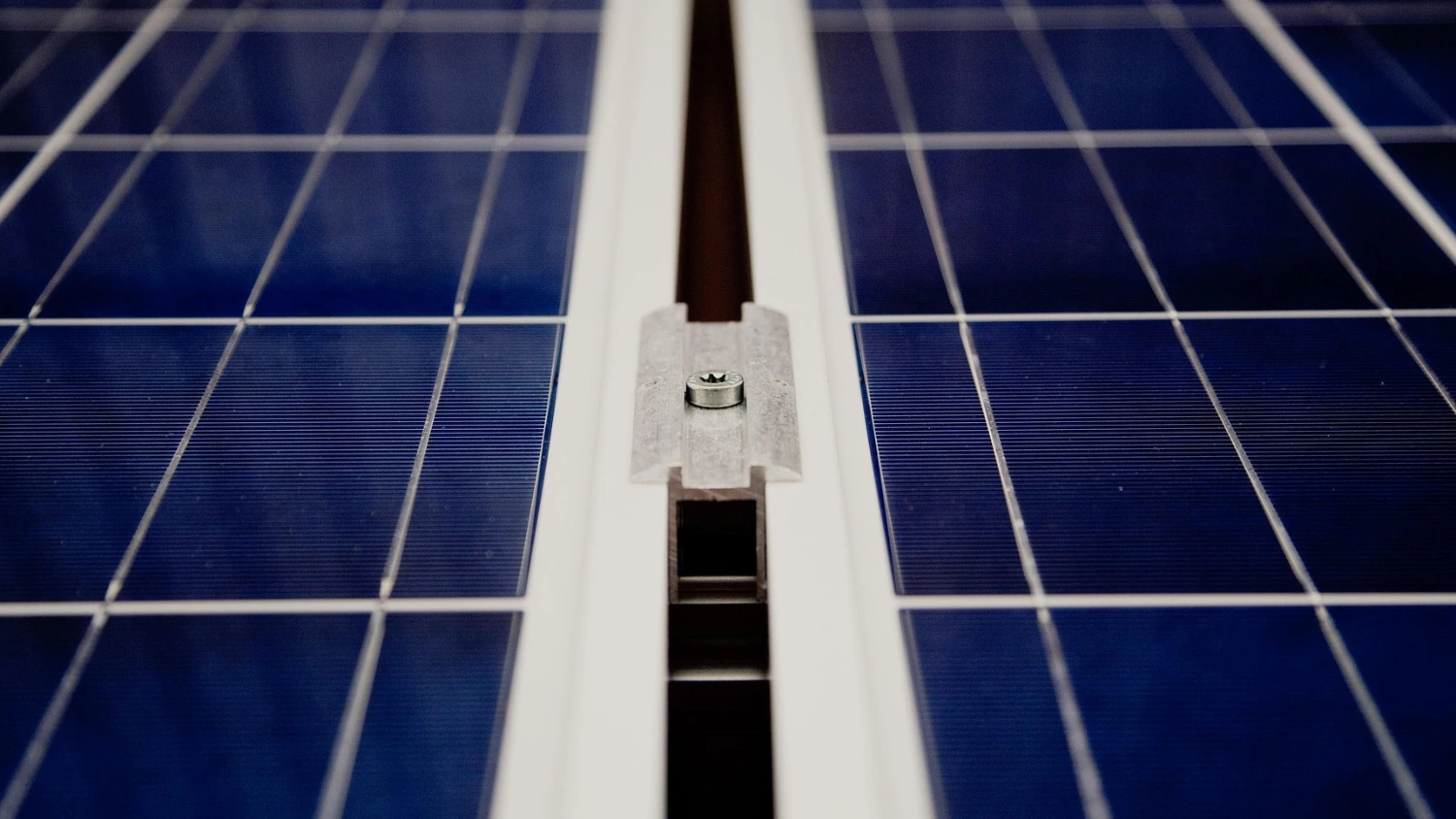

MOL Group operates three refineries and two petrochemicals plants under integrated supply chain-management in Hungary, Slovakia and Croatia. It owns a network of almost 2,400 service stations across 10 countries in Central & South Eastern Europe.