This marks the EBRD's inaugural capital relief transaction in Romania and UniCredit Bank's first venture into synthetic securitisation issuance.

Under the agreement, the EBRD will provide credit protection of up to €77.5 million on the mezzanine tranche of a synthetic securitisation. The underlying portfolio comprises a diverse range of loans to small and medium-sized enterprises (SMEs) and corporations originated by UniCredit Bank, a long-standing partner of the EBRD and a prominent bank in Romania.

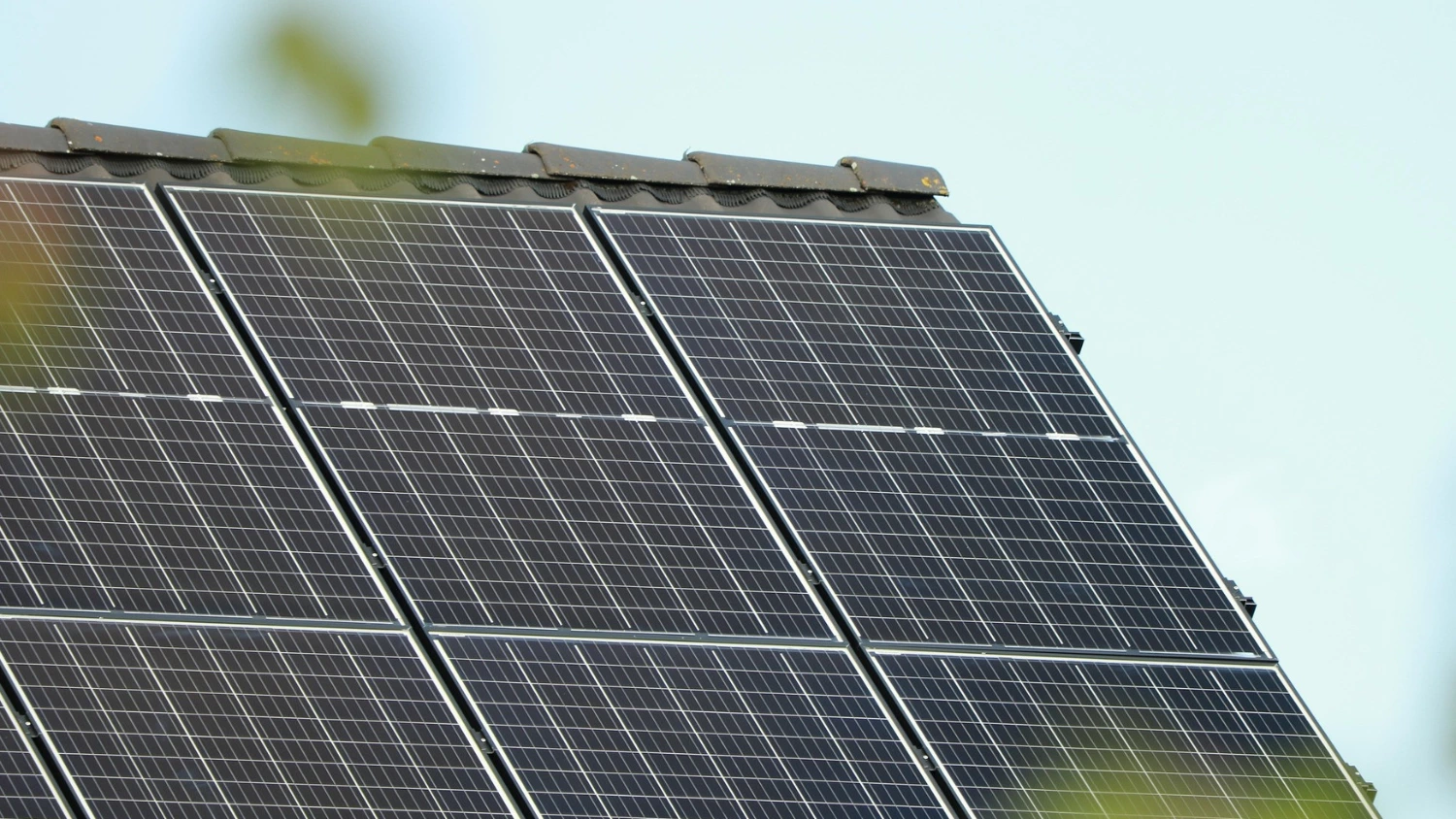

UniCredit Bank has pledged to redeploy an amount equivalent to 120 per cent of the EBRD guarantee towards new lending for SMEs and corporations within the country, with a specific focus on projects supporting climate action and environmental sustainability.

The transaction is part of UniCredit's ARTS programme for SRT transactions and underscores the bank's strategy to increasingly utilise SRT as an effective means of enhancing capital efficiency. The bank plans further expansion across new asset classes and legal entities within the UniCredit Group in central and eastern Europe.

UniCredit Bank GmbH acted as the sole arranger for UniCredit Bank S.A in this deal.

The EBRD has invested over €11.7 billion in 562 projects across Romania to date.