MidEuropa acquires majority stake in Romanian IT firm RBC

Private equity investor MidEuropa has acquired a majority stake in Romanian Business Consult (RBC), an IT system integrator specialising in retail, banking and industrial sectors in Romania.

Private equity investor MidEuropa has acquired a majority stake in Romanian Business Consult (RBC), an IT system integrator specialising in retail, banking and industrial sectors in Romania.

Private equity (PE) activity in Romania saw a significant uplift in H1 2025, with a total of 5 acquisitions and 5 exits finalized by PE funds.

Private equity firm Innova Capital has announced the launch of its Technology Advisory Board, which is the first of its kind in CEE.

Women account for just over one in five (21%) investment professionals in private equity (PE) and venture capital (VC) funds operating in Romania.

Optional pension funds in Romania can allocate up to 10% of their total assets to private equity investment funds in Romania, the EU, and OECD countries.

The ratio of Private Equity investment value to Romania's GDP is just 0.041%, ten times lower than the similar ratio at the European level.

Private equity (PE) fund investments in Central and Eastern Europe (CEE) reached a total volume of €1.71 billion in 2023, while Romania ranked 4th at the CEE level.

The Romanian private equity (PE) and venture capital (VC) sector has demonstrated significant contributions to job creation and economic growth.

Over 70% of the study participants anticipate an increase in the number of completed transactions in Romania by investment funds, after 20 were completed in 2023 transactions.

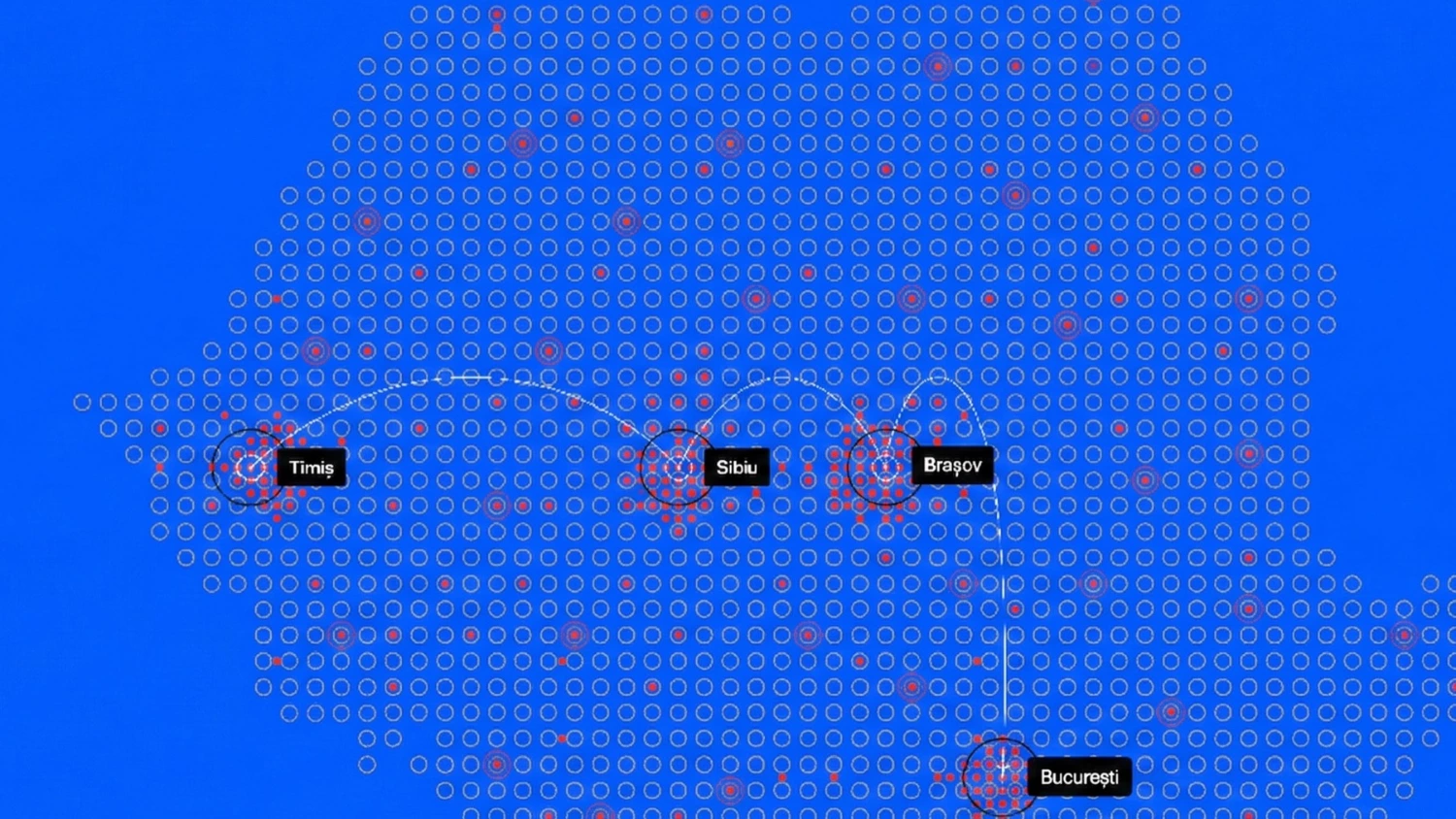

Romania's Government Private Cloud, the country's largest critical digital infrastructure, has entered operational stage nationwide.

Robert Anghel has taken over leadership of Salt Bank, replacing Gabriela Nistor remains close to Salt as a Board Member.

Romania has recorded one of the highest gender employment gaps in the European Union, significantly trailing the bloc's average, according to the latest data from Eurostat.

The latest escalation involving Iran has shifted markets away from “pure macro” indicators—rates, inflation and growth—and back toward geopolitics as a primary driver, according to an analysis by Freedom24.

Romanian deep-tech company Qognifly has launched Drone Wall, an autonomous counter-drone system developed by Romanian engineers and validated in operational conditions.