The company said investor demand exceeded supply by more than 11.5 times—a record for bond issuances by Romanian companies.

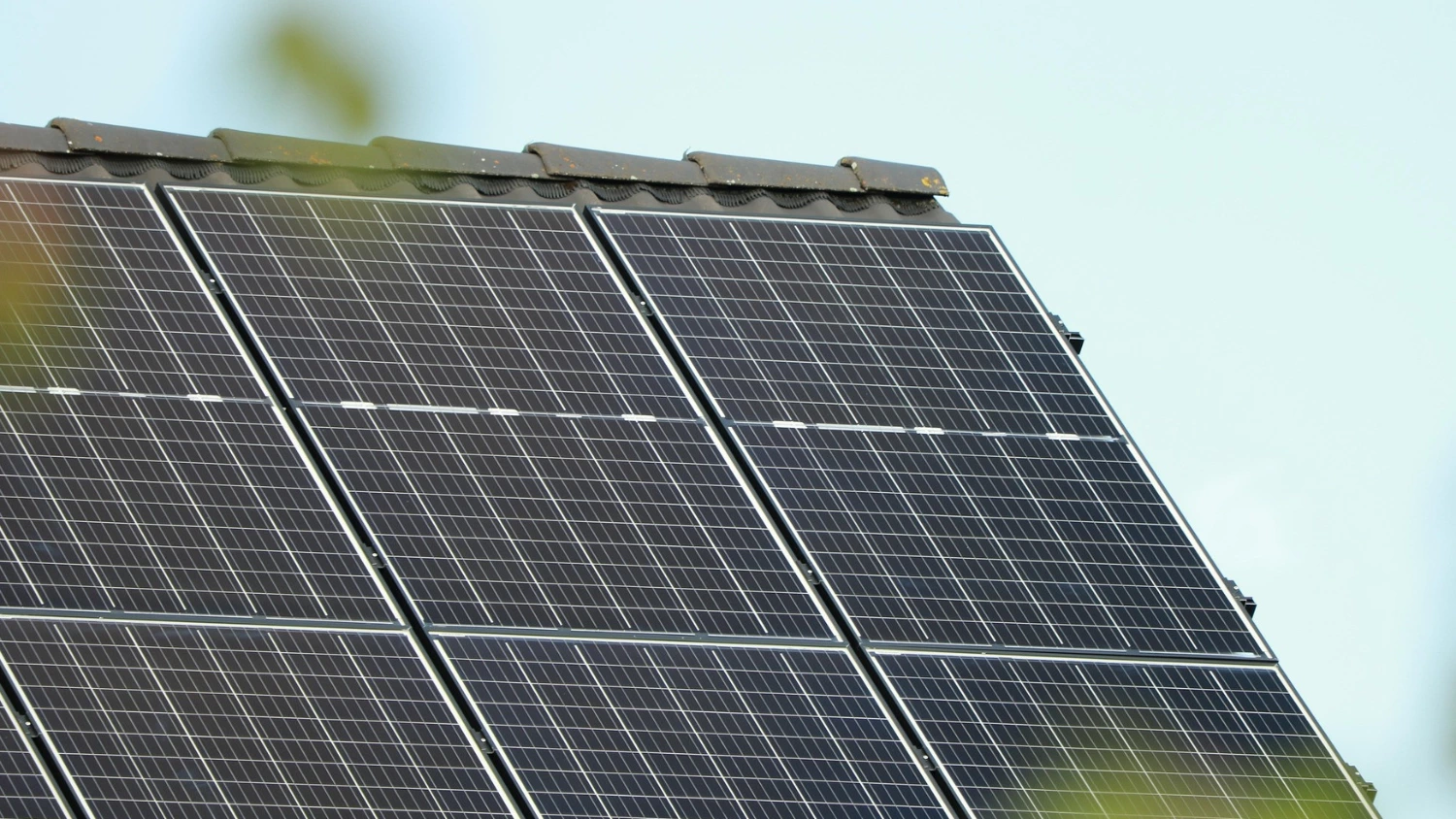

The proceeds from these green bonds will be deployed to finance and refinance the company investment plans for 1,000 MW of renewable energy capacities and around 900 MWh of energy storage facilities by 2030.

Alexandru Chiriță, CEO of Electrica, said: "It is not only Electrica's first bond issuance, but the biggest corporate green bond issuance in Romania (with the exception of Fis). It demonstrates our commitment to sustainable growth and environmental sustainability and our ability to attract substantial investor interest."

The bonds are expected to be listed on the Luxembourg Stock Exchange and subsequently on the Bucharest Stock Exchange.

BCR, BNP PARIBAS, Citi, ING, J.P. Morgan and Raiffeisen Bank International were Joint Global Coordinators and Joint Bookrunners, while BT Capital Partners, IMI-Intesa Sanpaolo, Societe Generale and UniCredit were Joint Bookrunners in the bond sale.