Globinvest launches new energy & financials ETF on BVB

SAI Globinvest, a Romanian investment management company, has launched the Globinvest Energy & Financials ETF,

SAI Globinvest, a Romanian investment management company, has launched the Globinvest Energy & Financials ETF,

Franklin Templeton International Services, the Sole Director and Alternative Investment Fund Manager of Fondul Proprietatea, has announced key management changes effective July 1 2025.

TeraPlast has announced the completion of its acquisition of a 51% stake in Aquatica Experience Group (AEG) in a deal worth €2 million.

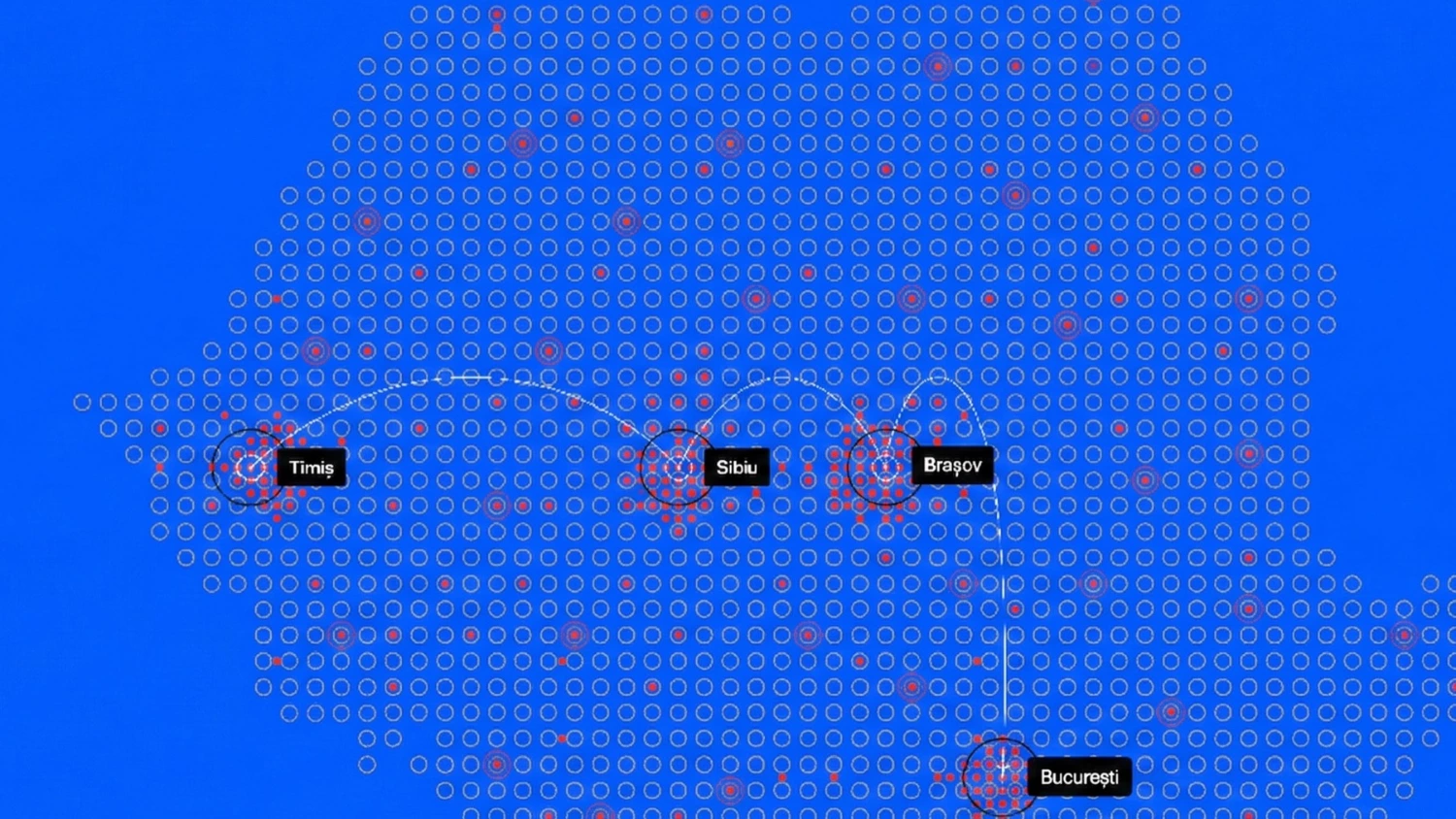

Electricity supplier Restart Energy One has filed a request at the Timiș Court for the initiation of a composition with creditors procedure to address temporary financial challenges.

The Fidelis government bonds, issued in April by the Ministry of Finance, started trading on the Bucharest Stock Exchange (BVB) on Thursday.

The average dividend yield proposed for shareholders' voting for a selection of companies within the BETPlus index is 4.8%, according to a Tradeville report.

Remus Vulpescu will be the new CEO of the Bucharest Stock Exchange (BVB) starting this summer, following a board decision

Premier Energy has announced its plans to acquire the remaining 25% stake in True Energy Management for €3 million.

The Bucharest Stock Exchange (BVB) indices were showing a significant upward trend in the first few hours of trading on Thursday compared to the previous day's close.

Every index of the Bucharest Stock Exchange recorded a decline at the beginning of the trading day on Monday.

Teilor Holding, encompassing the luxury jewelry chain Teilor, Teilor Invest Exchange, and Invest Intermed GF IFN, has announced the listing of two new bond issues on the Bucharest Stock Exchange (BVB).

Public food service company Sphera Franchise Group has earmarked approximately RON 100 million (around €20 million) for investments in 2025.

Stanleybet Capital, owner of a network of sports betting and slot machine agencies, has listed its second corporate bond issue worth RON 14.8 million (almost €3 million).

Arctic Stream, a public IT infrastructure and security integrator, has formalised the acquisition of a 23% stake in Data Core Systems (DCS).

Romanian engineering firm Simtel Team has announced the signing of a significant power purchase agreement (PPA).

The Romanian government has attracted almost RON 47.5 billion (EUR 9.6 billion) from retail investors through the 22 offers held since August 2020.

The number of fund investors is approaching the one million mark, a level which will most likely be reached in April.

Agroland Business System, the company operating the largest network of agricultural stores in Romania, today listed its second issue of its bonds.

InterCapital Asset Management, a Croatian independent investment manager with €550 million in assets, is launching a new ETF on the Bucharest Stock Exchange (BVB) starting Tuesday.

Romanian state-owned gas producer Romgaz is looking for a consultant for its planned purchase of Azomureș.

Romania's Government Private Cloud, the country's largest critical digital infrastructure, has entered operational stage nationwide.

Robert Anghel has taken over leadership of Salt Bank, replacing Gabriela Nistor remains close to Salt as a Board Member.

Romania has recorded one of the highest gender employment gaps in the European Union, significantly trailing the bloc's average, according to the latest data from Eurostat.

Romanian deep-tech company Qognifly has launched Drone Wall, an autonomous counter-drone system developed by Romanian engineers and validated in operational conditions.

Alive Capital will return to full ownership of founder Giacomo Billi following the transfer of Premier Energy's majority stake to Omnia Capital, Billi's investment holding.